The world has fallen into fiscal and monetary madness. Normally, increasing the supply of something causes its price to fall. Not so with U.S. bonds lately. President Bush is asking for $87 billion to nation build in Iraq and Afghanistan. The Federal deficit could top half a trillion dollars this year. Yet T-Bond futures are rising. How to explain this?

Ten Year Note Futures on the Rise

Only two ways, really, and the first is so unlikely as to barely deserve mentioning. But it could explain things. It COULD be that the bond market sees inflation ahead later this year.

In this scenario, we find the bond market and the Fed in a heated disagreement. The Fed plans to keep in short-term rates low for as long as it takes to “get America moving.”

The bond market, judging by the action in the futures market, thinks the Fed is wrong and that the economy is already moving.

I find this explanation…way too simple and completely at odds with the economic evidence. There’s no telling what the bond market is “thinking.” You can only see what it’s doing. And the latest commitment of traders report shows that for the reporting period ending September 2, Commercial traders are net long 53,097 contracts in T-bond futures. That’s a 15% increase from the previous week, says John Kosar at

Bianco Research. The “smart money” is still betting on a bond market rally.

But a bet on a bond market rally is not the same thing as a bet on inflation. In fact, it could be the opposite…a bet on Deflation. This is the second explanation for rising bond prices and one that makes more sense to me. It means the current global financial regime of U.S.-led consumption and Asian over-production may have a yet another round in it. No regime change yet.

Ultimately, this is only compounding the disaster for the world’s financial system. It encourages more U.S. debt, more global over production, and the bastard offspring of the both phenomena, debt deflation. And it’s putting the U.S. in a foreign policy in the hands of foreign bond holders. More on that in a moment.

For now, it looks like the Japanese and Chinese are content to keep their currencies low (and their exports competitive) by buying bonds with all those U.S. dollars they get from free-spending American debtors.

The Bush people must be of two minds about this. One, they know that cheap imports from Japan and China keep American consumers borrowing and spending. Good for GDP. Good for CNBC. Two, they know that cheap imports from China and Japan are profit killers for American manufacturers--and THAT is a political issue the Democrats are already running with. What to do?

Bush and Snow will make noise about Chinese revaluation. But it’s really up to the Chinese, not George Bush. Asia accounts for 39% of all U.S. bond purchases. Japan and China alone own a combined $565 billion in U.S. bonds.

This is the deflationary dynamic that’s bond supportive. Asia overproduces and takes global profit margins down to razor thin margins, driving out all the competition and dumping the dollar proceeds into bonds yielding 4%…or 3%….or 2%…or less.

A geopolitical eco/conspiracy question for you:

Could it be a calculated Chinese strategy to wreck the world’s economic and military hegemon (the U.S.) by deliberately producing below the cost of production…making more goods in China than can possibly be sold in the world in order to pummel American industry into oblivion?

It COULD be. But even if it’s not deliberate, it partly explains the persistent foreign buying of bonds despite the growing U.S. supply.

Time to own bond calls again.

TEN YEAR NOTES LOOKING BULLISH

Meet the New Russia: America 2004

Meet the New Russia: America 2004

You may be one of those investors who find it inconceivable that the United States is a bad credit risk. And when bond prices rise even as the U.S. twin deficits (federal and current account) get larger, it’s hard to argue that foreign buyers are getting nervous about the size of the debt.

And the conventional thinking is that foreign bondholders are in some way beholden to the dollar the more they buy U.S. bonds. After all, unless they support the dollar by buying U.S. assets, the dollar falls, and the value of their dollar-denominated assets falls with it.

But it IS possible that

in the near future, U.S. debt levels will be so high that it forces a huge revaluation of the dollar, whether anyone likes it or not. Who knows exactly what precipitates the reaction an investor has that a given piece of paper is not worth nearly what was paid for it? A housing recession. A unemployment rate of 10%?

Regardless of what will cause the dollar crash, foreign bondholders will suddenly find they have a tremendous amount of geo political leverage. U.S. debt will have to be paid, either in an inflated currency, or another, less conventional way, with a different kind of currency that you might call….policy complicity.

We may soon see the day when foreign bondholders call the shots on U.S foreign policy. In exchange for U.S. flexibility on say, the Palestinian question…or North Korea…or India…foreign bond holders either forgive a portion of the U.S. debt or renegotiate it on favorable terms. Sounds crazy? Maybe.

Think of how the Russians have turned their outstanding debts (and nuclear arsenal) into political leverage. No one can afford to let Russia fall apart. Russia, under Putin, has been able to use its delicate debtor status to renegotiate favorable terms on debt (rather than defaulting again), attract capital (to prevent catastrophe, of course), and exert a disproportionate influence on regional and global events.

It’s not exactly a position of strength. Yet it turns a primary weakness to its best use. It’s something U.S. politicians may need to learn quickly. Or course, they’ll probably keep right on spending until they’re forced to quit.

And it’s clear that

as long as U.S. politicians decide to pursue the War on Terror, the government is going to run larger and larger deficits. There will be no spending cuts in an election year. And it’s hard to imagine either Bush or a Democratic candidate taking office on a program of sweeping defense and domestic cuts. There may be a Democrat who will campaign to eliminate the Bush tax cuts. But not a one of them will touch spending.

And so higher the twin deficits go…at what price, we don’t yet know…

"Quick, there's a camera. Let's burn a flag..."

"Quick, there's a camera. Let's burn a flag..."

Everything printed is an effort to cause some change, in action, thought, or belief. It doesn't mean there isn't a version of events out there that more accurately reflects reality (the one I'm trying to put forward in the investment world.) But it does mean you should always be on your guard about being led around by the nose by the government AND the media.

Everything printed is an effort to cause some change, in action, thought, or belief. It doesn't mean there isn't a version of events out there that more accurately reflects reality (the one I'm trying to put forward in the investment world.) But it does mean you should always be on your guard about being led around by the nose by the government AND the media.

Next, the AMEX Euro top 100 Index. But for lack of liquidity, it would be a great proxy to be bullish or bearish the euro zone

Next, the AMEX Euro top 100 Index. But for lack of liquidity, it would be a great proxy to be bullish or bearish the euro zone  Then there's XEO, the S&P Euro 100 Index. Here, you haveliquidityy, and some reasonably priced options.

Then there's XEO, the S&P Euro 100 Index. Here, you haveliquidityy, and some reasonably priced options.

VS.

VS. And today, we have this from Reuters:

"Chinese factories powered ahead in August, churning out more cars, mobile phones and electronics to feed an insatiable export engine amid growing fears of an overheating economy.

"Industrial output grew 17.1% percent from the previous August. "

Song Guoqing the chief economist at China Stock Exchange Executive Council, said Chinese GDP would grown between 8% and 9%...in the THIRD QUARTER.

"A large proportion of such industrial goods are to be sold in the U.S. and European markets," he also said. You don't say?

August's year-over-year rise was even better than the 16.5% rise in July and the 16.9% rise in June. Don't look now...but that looks like a sustained and perhaps, intentional rise, in production. It's possible this is post-SARS back-log kicking in.

But it's also possible that a rising Eastern power realizes it can't compete militarily with a U.S. hyper power at its zenith. Yet the Chinese covet Middle Eastern oil. And they know that in the long run, there is probably more consumption growth to be had in the younger economies of Asia than in the American market.

If you assumed that at some point in the next 50 years you and the Americans were going to be in a contest for scarce natural resources, and that as long as the Americans had the guns and navies and planes, you couldn't compete with them in conventional military ways, what would you do? What kind of unconventional war would you fight? Economic?

Would you systematically over produce manufactured goods to gut your chief rival's industrial base? Would you use the dollars you got back from your huge export surplus to buy his bonds and literally indebt him to you? Or would you use those dollars to buy his factories and companies from him?

And after doing this for 10 years or so, how much of his financial strength would you have eroded, or transferred to yourself? Would he have the resources to finance his military adventures anymore? And by owning his factories and a good chunk of his bonds, would you exercise a leverage over his foreign policy decisions that gave you everything you could gain from a military victory, without ever firing a single shot?

And today, we have this from Reuters:

"Chinese factories powered ahead in August, churning out more cars, mobile phones and electronics to feed an insatiable export engine amid growing fears of an overheating economy.

"Industrial output grew 17.1% percent from the previous August. "

Song Guoqing the chief economist at China Stock Exchange Executive Council, said Chinese GDP would grown between 8% and 9%...in the THIRD QUARTER.

"A large proportion of such industrial goods are to be sold in the U.S. and European markets," he also said. You don't say?

August's year-over-year rise was even better than the 16.5% rise in July and the 16.9% rise in June. Don't look now...but that looks like a sustained and perhaps, intentional rise, in production. It's possible this is post-SARS back-log kicking in.

But it's also possible that a rising Eastern power realizes it can't compete militarily with a U.S. hyper power at its zenith. Yet the Chinese covet Middle Eastern oil. And they know that in the long run, there is probably more consumption growth to be had in the younger economies of Asia than in the American market.

If you assumed that at some point in the next 50 years you and the Americans were going to be in a contest for scarce natural resources, and that as long as the Americans had the guns and navies and planes, you couldn't compete with them in conventional military ways, what would you do? What kind of unconventional war would you fight? Economic?

Would you systematically over produce manufactured goods to gut your chief rival's industrial base? Would you use the dollars you got back from your huge export surplus to buy his bonds and literally indebt him to you? Or would you use those dollars to buy his factories and companies from him?

And after doing this for 10 years or so, how much of his financial strength would you have eroded, or transferred to yourself? Would he have the resources to finance his military adventures anymore? And by owning his factories and a good chunk of his bonds, would you exercise a leverage over his foreign policy decisions that gave you everything you could gain from a military victory, without ever firing a single shot?

Later this week I’m going to show you an easy way to own physical gold. But for most investors, the easiest way to own gold will be through an exchange traded fund backed by bullion. ETFs, ishares, and HOLDERS, all of which I call precision guided investments, are simple ways to own a liquidly traded basket of stocks in a specific sector, country, or asset class.

Index funds, which are not actively managed, have much lower expense ratios than mutual funds. And you can trade them during the day. Imagine that…not only do you not have to pay some hot shot’s big salary…you don’t have to risk him letting his banker buddies trade your mutual fund after the close at prices you don’t get.

It’s a much better deal for the average investor. And it’s one reason I think this IS the new investment strategy for a high-risk, low-return market. You lower your costs, take more intelligent risks, and if you wish, leverage it with options.

Wall Street knows the public never tires of new investment products, especially ones that actually make investors money. That’s why I wasn’t too surprised to see an article in today’s Wall Street Journal over a brewing debate between the exchanges about how to list index options. A few exchanges want options listed on multiple paces. Others want to maintain the status quo.

Right now, each individual exchange bids for the right list options on a particular index. For example, the Philadelphia Stock Exchange recently beat out the Pacific Exchange over the right to trade options on the Nasdaq Composite.

When you consider that the Qs, the tracking stock for the Nasdaq 100, did over 69 million shares in volume yesterday and had the third highest trading volume of all U.S. listed securities…you can see why getting the rights to trade options on a popular index makes a difference to even a large exchange. Heavy trading volume generates huge revenues for an exchange.

If index options get listed on multiple exchanges, you’ll see more volume, more liquidity, and probably tighter spreads. This is all good news. The Philly stock exchange says it’s less likely to list index options if they’re listed in multiple places. And of course it would say that. After all, less profit if you have to share trading and spreads get tighter.

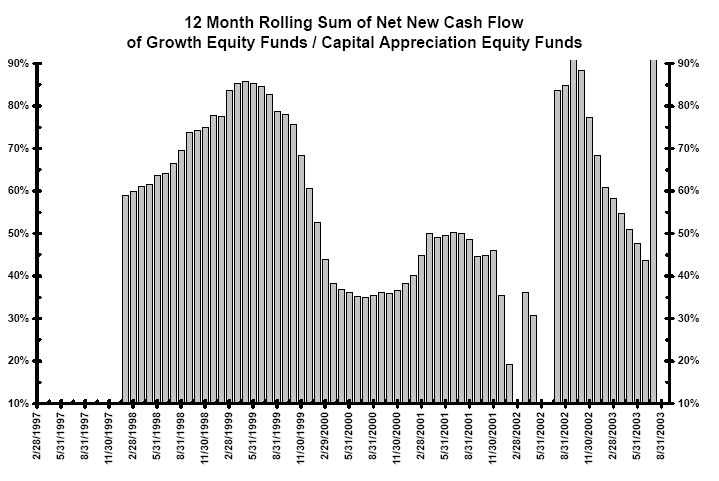

The mutual fund industry is already in trouble with its high management fees and poor performance. And with this new scandal coming out about illegal trading--it could deal a deathblow to investor confidence in the fund industry. In fact, look at the chart below courtesy of the top-shelf guys at Bianco. It shows you just what can happen when the retail investors loses confidence in an idea. His cash does the talking. (also note the disturbing recent spike of cash back into growth and capital appreciation equity funds...a sure sign that the hyper-bull mentality is back, at least for a few months)

When Panic Attacks: Cash Can Leave Funds as Quickly as it Flows to Them

Later this week I’m going to show you an easy way to own physical gold. But for most investors, the easiest way to own gold will be through an exchange traded fund backed by bullion. ETFs, ishares, and HOLDERS, all of which I call precision guided investments, are simple ways to own a liquidly traded basket of stocks in a specific sector, country, or asset class.

Index funds, which are not actively managed, have much lower expense ratios than mutual funds. And you can trade them during the day. Imagine that…not only do you not have to pay some hot shot’s big salary…you don’t have to risk him letting his banker buddies trade your mutual fund after the close at prices you don’t get.

It’s a much better deal for the average investor. And it’s one reason I think this IS the new investment strategy for a high-risk, low-return market. You lower your costs, take more intelligent risks, and if you wish, leverage it with options.

Wall Street knows the public never tires of new investment products, especially ones that actually make investors money. That’s why I wasn’t too surprised to see an article in today’s Wall Street Journal over a brewing debate between the exchanges about how to list index options. A few exchanges want options listed on multiple paces. Others want to maintain the status quo.

Right now, each individual exchange bids for the right list options on a particular index. For example, the Philadelphia Stock Exchange recently beat out the Pacific Exchange over the right to trade options on the Nasdaq Composite.

When you consider that the Qs, the tracking stock for the Nasdaq 100, did over 69 million shares in volume yesterday and had the third highest trading volume of all U.S. listed securities…you can see why getting the rights to trade options on a popular index makes a difference to even a large exchange. Heavy trading volume generates huge revenues for an exchange.

If index options get listed on multiple exchanges, you’ll see more volume, more liquidity, and probably tighter spreads. This is all good news. The Philly stock exchange says it’s less likely to list index options if they’re listed in multiple places. And of course it would say that. After all, less profit if you have to share trading and spreads get tighter.

The mutual fund industry is already in trouble with its high management fees and poor performance. And with this new scandal coming out about illegal trading--it could deal a deathblow to investor confidence in the fund industry. In fact, look at the chart below courtesy of the top-shelf guys at Bianco. It shows you just what can happen when the retail investors loses confidence in an idea. His cash does the talking. (also note the disturbing recent spike of cash back into growth and capital appreciation equity funds...a sure sign that the hyper-bull mentality is back, at least for a few months)

When Panic Attacks: Cash Can Leave Funds as Quickly as it Flows to Them

What better product to fill the void than index ETFs? If the ETF can start getting more assets under management, it could replace the mutual fund industry entirely. There will be issues to be worked out, like making it possible for 401(k) investors to get in and out of ETFs and trade options.

But the investment demand is already there. It’s a matter of when, not if.

What better product to fill the void than index ETFs? If the ETF can start getting more assets under management, it could replace the mutual fund industry entirely. There will be issues to be worked out, like making it possible for 401(k) investors to get in and out of ETFs and trade options.

But the investment demand is already there. It’s a matter of when, not if.

Only two ways, really, and the first is so unlikely as to barely deserve mentioning. But it could explain things. It COULD be that the bond market sees inflation ahead later this year.

In this scenario, we find the bond market and the Fed in a heated disagreement. The Fed plans to keep in short-term rates low for as long as it takes to “get America moving.” The bond market, judging by the action in the futures market, thinks the Fed is wrong and that the economy is already moving.

I find this explanation…way too simple and completely at odds with the economic evidence. There’s no telling what the bond market is “thinking.” You can only see what it’s doing. And the latest commitment of traders report shows that for the reporting period ending September 2, Commercial traders are net long 53,097 contracts in T-bond futures. That’s a 15% increase from the previous week, says John Kosar at

Only two ways, really, and the first is so unlikely as to barely deserve mentioning. But it could explain things. It COULD be that the bond market sees inflation ahead later this year.

In this scenario, we find the bond market and the Fed in a heated disagreement. The Fed plans to keep in short-term rates low for as long as it takes to “get America moving.” The bond market, judging by the action in the futures market, thinks the Fed is wrong and that the economy is already moving.

I find this explanation…way too simple and completely at odds with the economic evidence. There’s no telling what the bond market is “thinking.” You can only see what it’s doing. And the latest commitment of traders report shows that for the reporting period ending September 2, Commercial traders are net long 53,097 contracts in T-bond futures. That’s a 15% increase from the previous week, says John Kosar at  Meet the New Russia: America 2004

You may be one of those investors who find it inconceivable that the United States is a bad credit risk. And when bond prices rise even as the U.S. twin deficits (federal and current account) get larger, it’s hard to argue that foreign buyers are getting nervous about the size of the debt.

And the conventional thinking is that foreign bondholders are in some way beholden to the dollar the more they buy U.S. bonds. After all, unless they support the dollar by buying U.S. assets, the dollar falls, and the value of their dollar-denominated assets falls with it.

But it IS possible that in the near future, U.S. debt levels will be so high that it forces a huge revaluation of the dollar, whether anyone likes it or not. Who knows exactly what precipitates the reaction an investor has that a given piece of paper is not worth nearly what was paid for it? A housing recession. A unemployment rate of 10%?

Regardless of what will cause the dollar crash, foreign bondholders will suddenly find they have a tremendous amount of geo political leverage. U.S. debt will have to be paid, either in an inflated currency, or another, less conventional way, with a different kind of currency that you might call….policy complicity.

We may soon see the day when foreign bondholders call the shots on U.S foreign policy. In exchange for U.S. flexibility on say, the Palestinian question…or North Korea…or India…foreign bond holders either forgive a portion of the U.S. debt or renegotiate it on favorable terms. Sounds crazy? Maybe.

Think of how the Russians have turned their outstanding debts (and nuclear arsenal) into political leverage. No one can afford to let Russia fall apart. Russia, under Putin, has been able to use its delicate debtor status to renegotiate favorable terms on debt (rather than defaulting again), attract capital (to prevent catastrophe, of course), and exert a disproportionate influence on regional and global events.

It’s not exactly a position of strength. Yet it turns a primary weakness to its best use. It’s something U.S. politicians may need to learn quickly. Or course, they’ll probably keep right on spending until they’re forced to quit.

And it’s clear that as long as U.S. politicians decide to pursue the War on Terror, the government is going to run larger and larger deficits. There will be no spending cuts in an election year. And it’s hard to imagine either Bush or a Democratic candidate taking office on a program of sweeping defense and domestic cuts. There may be a Democrat who will campaign to eliminate the Bush tax cuts. But not a one of them will touch spending.

And so higher the twin deficits go…at what price, we don’t yet know…

Meet the New Russia: America 2004

You may be one of those investors who find it inconceivable that the United States is a bad credit risk. And when bond prices rise even as the U.S. twin deficits (federal and current account) get larger, it’s hard to argue that foreign buyers are getting nervous about the size of the debt.

And the conventional thinking is that foreign bondholders are in some way beholden to the dollar the more they buy U.S. bonds. After all, unless they support the dollar by buying U.S. assets, the dollar falls, and the value of their dollar-denominated assets falls with it.

But it IS possible that in the near future, U.S. debt levels will be so high that it forces a huge revaluation of the dollar, whether anyone likes it or not. Who knows exactly what precipitates the reaction an investor has that a given piece of paper is not worth nearly what was paid for it? A housing recession. A unemployment rate of 10%?

Regardless of what will cause the dollar crash, foreign bondholders will suddenly find they have a tremendous amount of geo political leverage. U.S. debt will have to be paid, either in an inflated currency, or another, less conventional way, with a different kind of currency that you might call….policy complicity.

We may soon see the day when foreign bondholders call the shots on U.S foreign policy. In exchange for U.S. flexibility on say, the Palestinian question…or North Korea…or India…foreign bond holders either forgive a portion of the U.S. debt or renegotiate it on favorable terms. Sounds crazy? Maybe.

Think of how the Russians have turned their outstanding debts (and nuclear arsenal) into political leverage. No one can afford to let Russia fall apart. Russia, under Putin, has been able to use its delicate debtor status to renegotiate favorable terms on debt (rather than defaulting again), attract capital (to prevent catastrophe, of course), and exert a disproportionate influence on regional and global events.

It’s not exactly a position of strength. Yet it turns a primary weakness to its best use. It’s something U.S. politicians may need to learn quickly. Or course, they’ll probably keep right on spending until they’re forced to quit.

And it’s clear that as long as U.S. politicians decide to pursue the War on Terror, the government is going to run larger and larger deficits. There will be no spending cuts in an election year. And it’s hard to imagine either Bush or a Democratic candidate taking office on a program of sweeping defense and domestic cuts. There may be a Democrat who will campaign to eliminate the Bush tax cuts. But not a one of them will touch spending.

And so higher the twin deficits go…at what price, we don’t yet know…